April Montana Housing Market Update

First of all, thanks to YOU I was nominated for Best of Missoula’s Best Realtor. If you appreciate these market reports, please take the time to vote for me HERE. You can vote up to once per day. https://missoulian.com/contests/best-of-missoula-2023/

The Big Picture

Nationwide, there are 2 big economic trends influencing the housing market that I’m watching: economic growth and unemployment. GDP only grew 1% in the first quarter of this year, where experts expected 2-2.5% of economic growth. What does that mean? While several things contribute, the simplified version is that businesses and consumers spent less money. Inflation is also slowing, with the March Consumer Price Index at 5% year-on-year, the smallest increase since May, 2021.

Why You Should Care

The economy has been growing quickly, and the government is trying to slow it down by raising the interest rates. The Fed is expected to raise rates by .25% next week, but they have indicated this is the last increase for now. The First Republic Bank failure could postpone this rate change, but we will have to see what they do! Several prediction models are expecting mortgage interest rates to decline later this year.

Unemployment Trends

Employment is the other leg holding up the US economy. While unemployment is still historically low, new US unemployment claims are trending up. In particular, high income earners making more than $200,000 (hello big tech software engineers!) have filed for unemployment benefits at a record pace in recent weeks, according to Business Insider. https://markets.businessinsider.com/news/stocks/inflation-plunge-wage-growth-high-income-earners-unemployment-benefits-record-2023-4

Why You Should Care

High unemployment tends to correlate with lower home prices. Here in Montana, the unemployment rate was just 2.3% in February, an all time low for the state. With home construction and tourist season just ramping up, higher unemployment in Western Montana this summer would be surprising. Out of state tech layoffs are likely to have a bigger impact on the 2nd home markets in Lake and Flathead Counties, and on luxury home prices. Moderately priced homes in Missoula, and the connecting valleys are likely to continue to go up in value unless the unemployment rate goes up.

These 2 headlines showed up in my email inbox today. One said Homebuyer Demand Jumps After Interest Rates Drop to New Low while the other headline said Home Sales Fall As Economy Shows Sign Of Stalling. This tells the story of the current housing market paradox. Just remember: all real estate is local.

Housing Trends In Western Montana

Across the region new listings are down, closed sales are down, homes have been taking longer to sell than a year ago, and a little more inventory is available. The main problem is that the homes for sale aren’t what most people can afford.

Missoula County Market Report

In the city of Missoula, buyer demand remains strong and inventory of single family homes isn’t keeping up. Looking at all of Missoula County, the median home price was $525,000 in March, a modest 1.9% increase from a year ago. However, focusing on single family homes in city limits the median price was up to $611,250- a 15.3% gain from March of 2022. As we move into spring weather, Missoula single family homes are moving fast and getting multiple offers. There are the normal exceptions to this for higher prices, weird layouts, or homes needing extensive improvements. Buyers are more selective than during the pandemic frenzy, but low inventory for affordable homes is making the buying process more competitive now than over fall and winter.

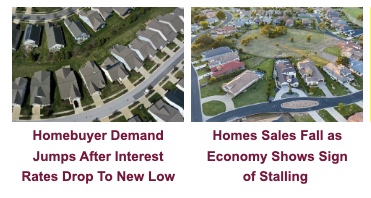

Looking closer at the housing supply, across all price points it would take 2.5 months to sell every home on the market. (A balanced market is 3-6 months of inventory.) However, there was 1.2 months supply of homes under $450,000, many of which were manufactured homes. There were 1.6 months supply for home $450,000-650,000 in March. This was an improvement from the last two years, but it still gives sellers an advantage. In the luxury housing market (homes sold for over $850,000) Missoula has 8.9 months on inventory, so buyers have more power to negotiate.

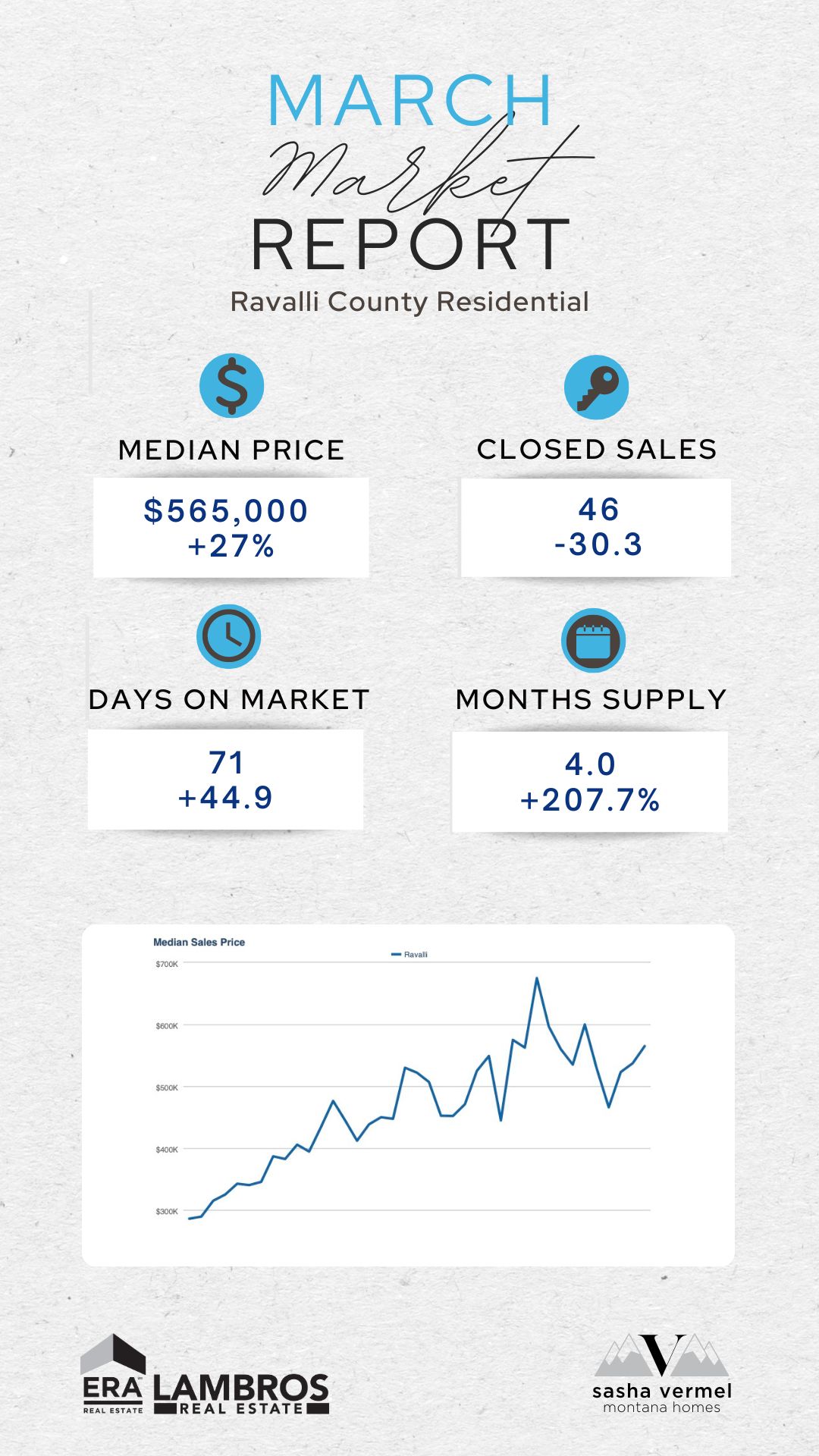

Ravalli County Housing Market Report

Ravalli County’s median home price was $565,000, up 27% from a year ago. However, the median price in March, 2022 was surprisingly low, so that percentage is a little misleading. Ravalli county has more inventory relative to demand than Missoula, but there aren’t enough low and mid priced homes on the market. It is getting increasingly hard to find a home for under $450,000 north of Stevensville in the Bitterroot Valley.

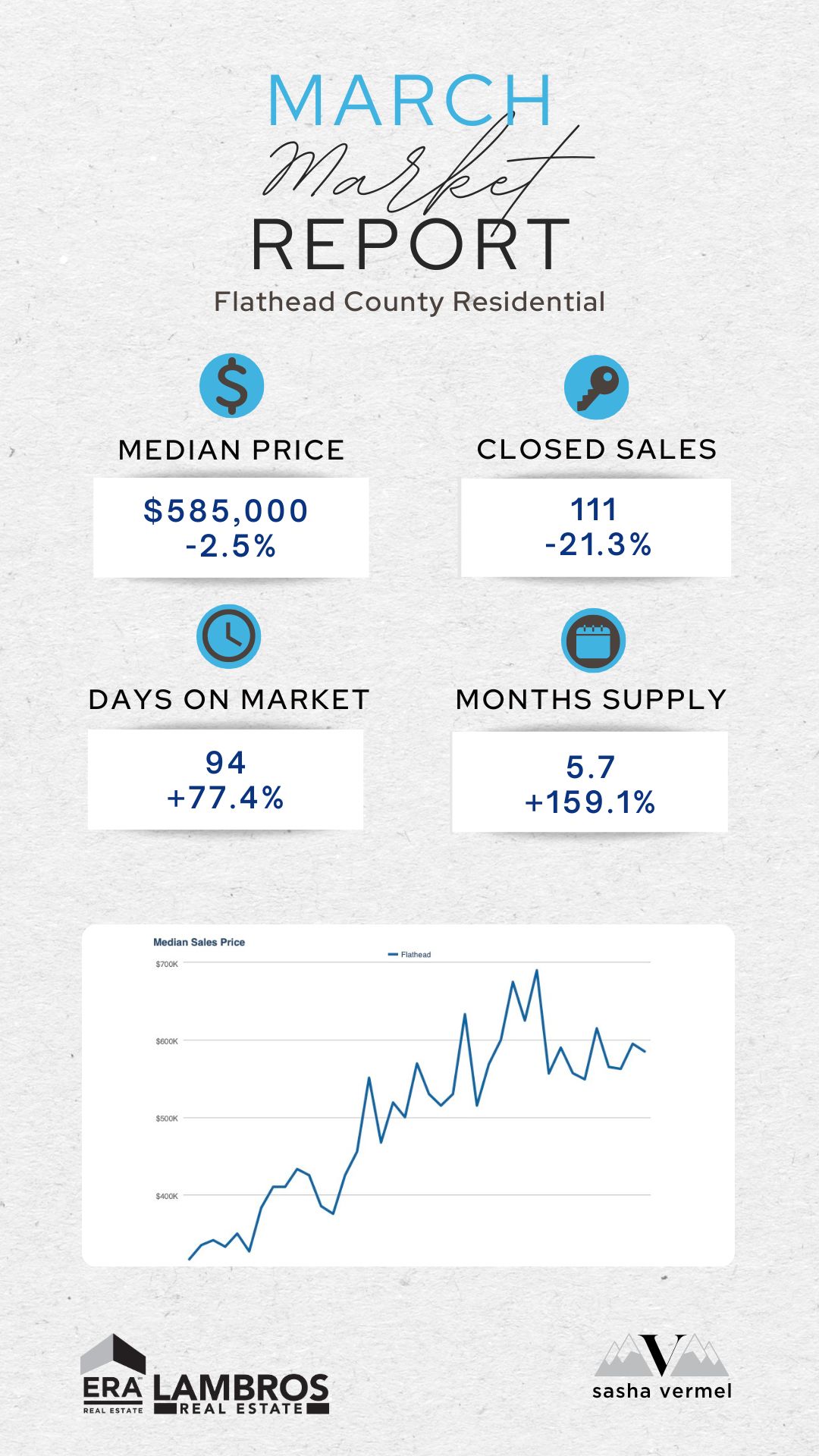

Flathead County Market Report

Flathead County’s market looks a little different. Demand for homes is similar to Missoula, but Flathead has a lot more inventory. Comparing, Missoula county had 254 active home listings in March, while Flathead had 707. Looking city to city, Missoula’s sellers are getting a median 99.2% of list price, while both Kalispell and Whitefish sellers are receiving 97.1% of list price. As a result, in March the median sales price was down 2.5% from last year at $585,000.

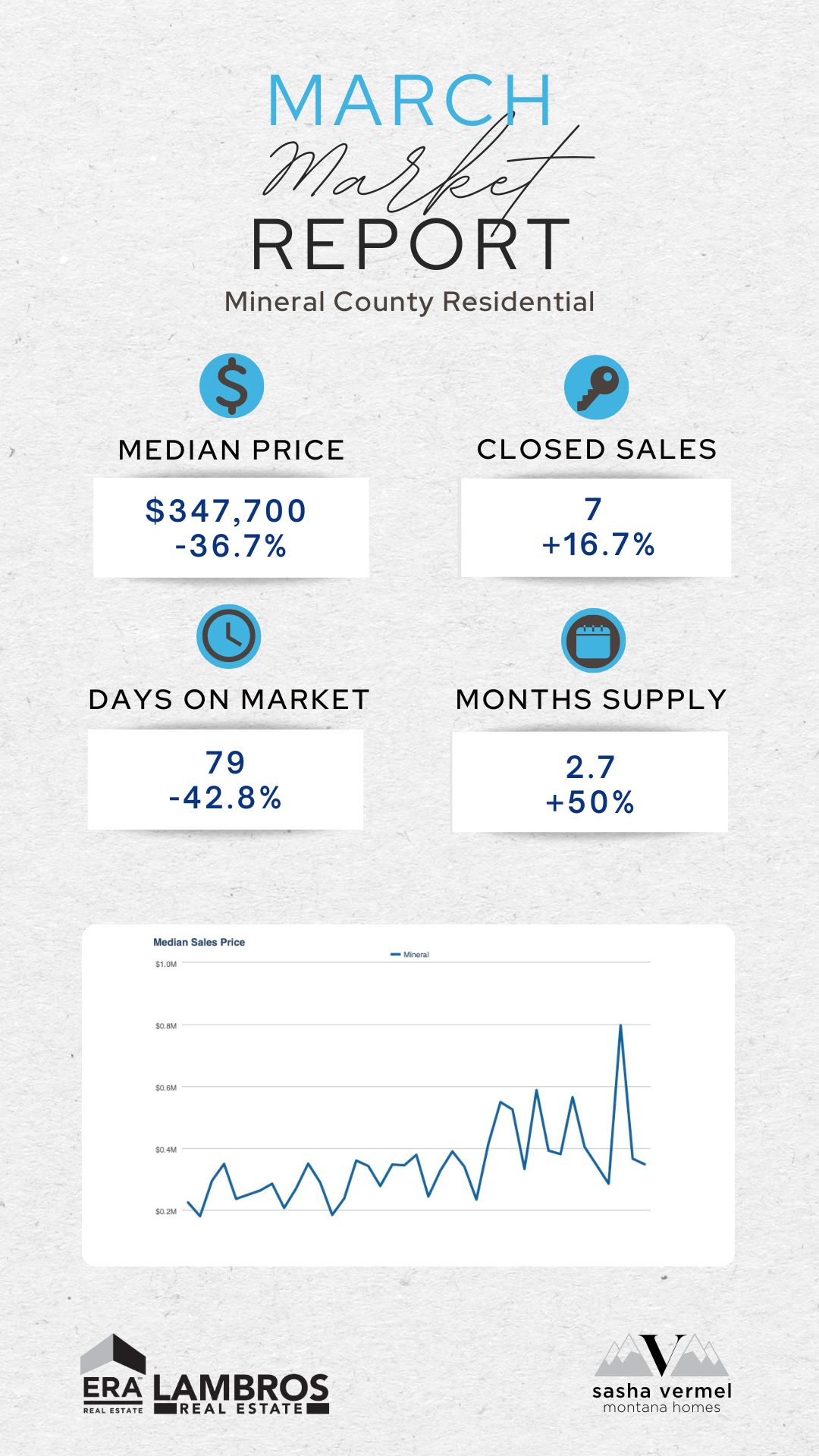

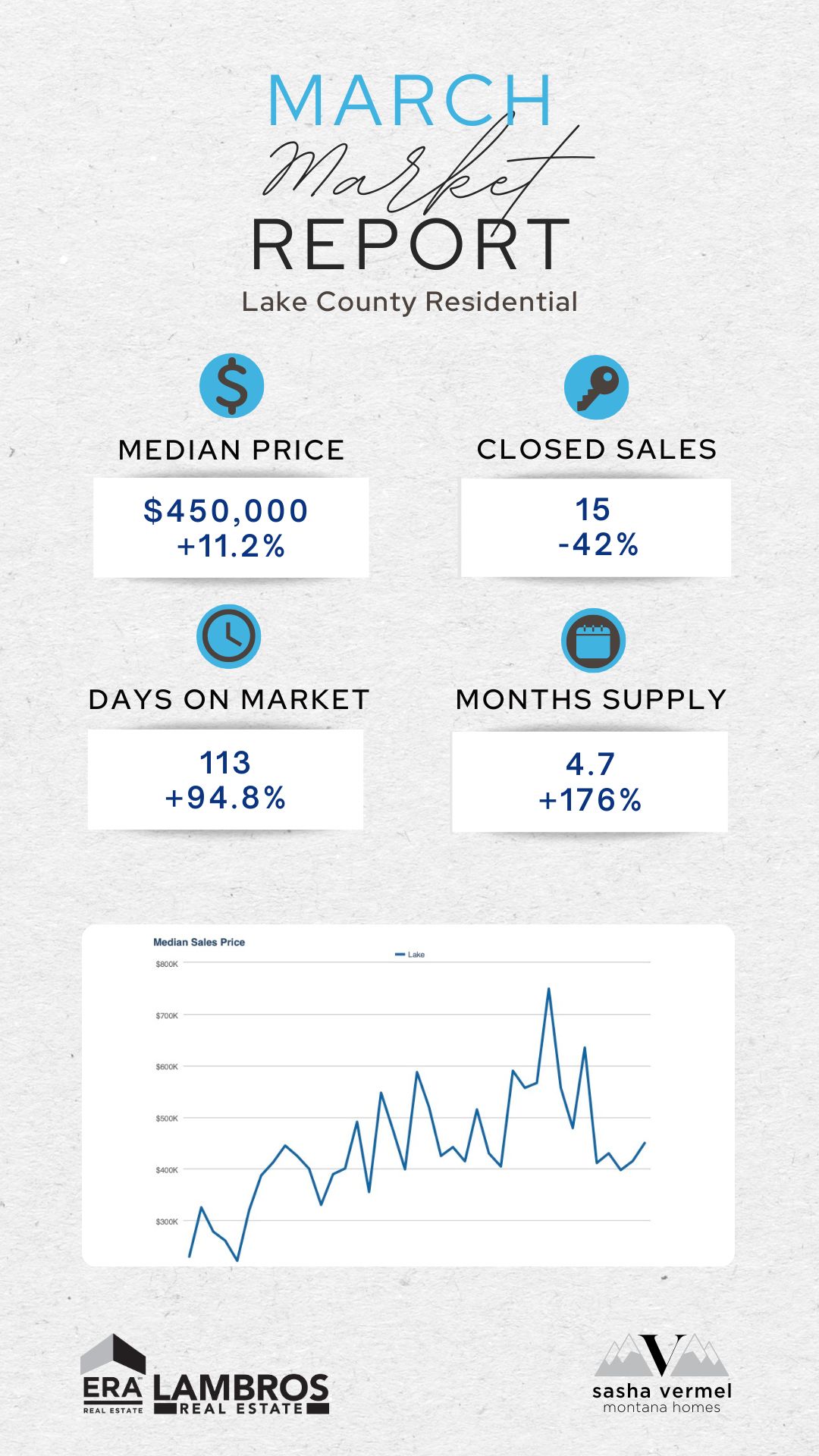

Mineral And Lake County Market Reports

Inventory and sales are very low in both Mineral and Lake counties. Lake county had a larger price correction from last summer, while Mineral county has a median price that fluctuates month to month, but generally trends upward.

How to Capitalize On Current Housing Market Trends

Now is a great time to sell in Missoula and the surrounding valleys. Inventory is low, and buyer demand is strong.

Looking for a luxury property? Try negotiating for a bargain. Buyers are paying an average of 87% of list price for home over $1,000,000 in Missoula County.

For recent and future buyers, it’s worth asking your lender about low or no-cost refinance policies if interest rates decrease in the next six to twelve months. With home prices expected to keep rising, run the numbers to see if it is wiser to buy now and refi later.

To get regular updates on new listings and market data targeted to your neighborhood, sign up for neighborhood news HERE!

As always, if you know anyone who wants to buy or sell and would benefit from this newsletter or my services, please let me know!

December 2022 Northwestern Montana Market Update

Happy New Year! It’s 2023, I’m pouring over market statistics for December 2022 for Northwestern Montana, and despite gloomy national headlines I feel optimistic.

One year ago today, there were about 40 homes on the market in the city of Missoula, and today that number is 155. One year ago, if buyers weren’t able to make an offer over asking price, or if they had a home to sell before they could close, they were unlikely to win the bidding war to buy a home. Today, homes are selling for under asking price- an average of 95-98% of asking price, and offers that are contingent on the sale of the buyer’s home are going under contract. Sellers are willing to negotiate on inspection issues and are even willing to cover closing costs.

Newer and remodeled homes in popular neighborhoods may still have multiple offers or go for asking price, but homes that need repairs or updates and are further away from jobs and services are less expensive than they were a year ago. This creates an opportunity to own a home for people with smaller budgets. I would argue that the state of our local housing market in North Western Montana is showing signs of health, and that the new normal is more balanced between buyers and sellers. In my opinion, the shifts in the last 6 months are actually good.

Where are home prices now and where are they headed?

In Missoula County, the December median sales price was $545,000, up 11.8% over December of 2021, while in Flathead County the median sales price was $569,000, down 10.4% from this time last year. Ravalli, Lake, and Mineral Counties all fall somewhere in between. All of these regions saw a median price spike at the beginning of summer 2022, and then have leveled out or declined a bit since then. Why the big difference between Missoula and Flathead?

Inventory

While there are many things driving this difference, I suspect that a major factor is inventory. While Missoula County has the larger population, Flathead county has more than twice as many homes for sale compared to Missoula County (534 on the market in Flathead County vs 248 in Missoula). Because Flathead County has been increasing in population faster than Missoula, I suspect that the inventory difference is not demand, but because it is easier and cheaper to build up north than it is in the Missoula Valley.

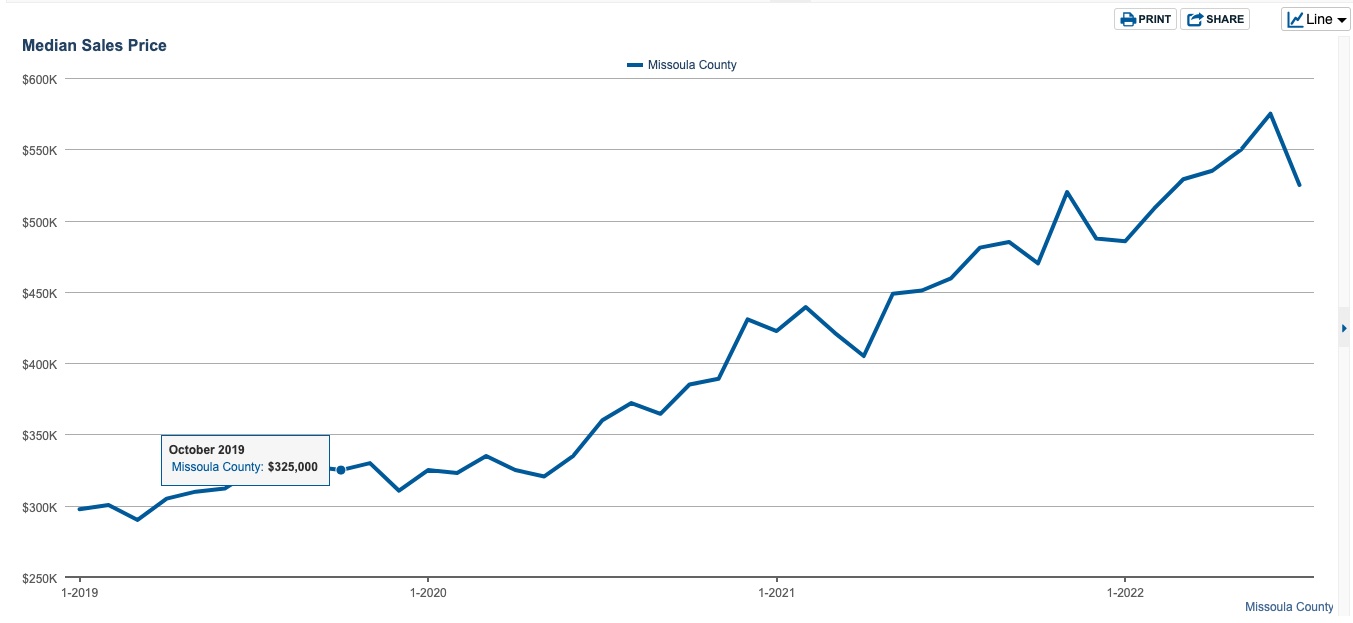

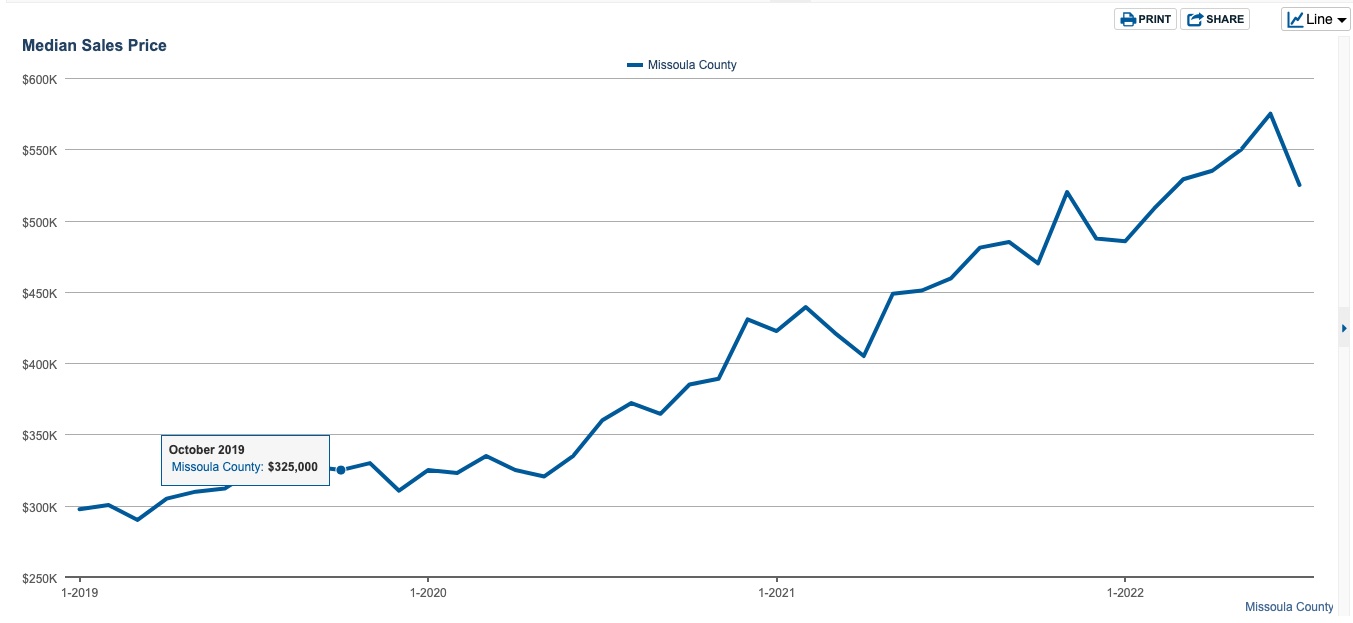

One year ago, I was writing to you about low interest rates and low inventory working together to increase prices. With those working together, home prices appreciated more than 20% per year in the pandemic buying spree.

Now imagine low inventory and higher interest rates in an arm wrestling match to determine where prices go. Regions with more inventory are going to experience more of a price correction unless that inventory is also matched by pent up demand. Our region still has plenty of potential buyers who want the opportunity to own their own home. Montana unemployment was at 2.9% in November 2022 according to the Bureau of Labor Statistics. As long as low unemployment holds, I predict very modest median home price growth this year in Missoula County, and prices to remain flat in the adjacent counties.

For perspective, here is a chart from the St. Louis Fed showing 40 years of the Average Sales Price for Houses Sold in the US. The two things I want you to notice are that over the long arc of time, home prices have increased, and how unprecedented the price spike was between March 2020 through summer 2022.

Interest Rates

The average mortgage interest rate one year ago was around 3.22% according to Forbes Magazine. We watched as it more than doubled this year as the Fed raised the Fed Funds Rate repeatedly in its effort to slow inflation.

A funny thing happened in November: the Fed raised their rate, but mortgage rates didn’t go up. The Fed then raised rates in December, but mortgage interest rates had already started to fall. I get an email every business day with the average interest rates from one particular bank, and in this email on November 1, 2022 the 30 year conventional mortgage a high of 7.5%. Today as I write this newsletter, that number is 6.0%. (Disclaimer: your rates may vary.) Historically, most of the 2000’s the 30 year mortgage was at about 6%, which was still way less than the rates for anyone who bought a home between 1970-2000.

If you want to know why mortgage rates are defying the Fed’s increases, in part it’s because new mortgage demand is so low that banks have to entice borrowers back. Another piece is that the stock market hasn’t been making investors money in the past 12 months, so there are more people willing to invest in mortgage backed securities. Mortgage backed securities are batches of loans bundled together that give investors a return proportional to the mortgage interest rate. (You may be having bad 2008 flashbacks when subprime mortgages were bundled up with good mortgages into mortgage backed securities, and crashed the entire US financial system. Please note: regulations have made it much harder for banks to give out risky loans, as anyone who tried to qualify for a loan in the past few years could tell you.) Banks are willing to make more loans where there is more demand from investors to buy them up. Usually the #1 investor in mortgage backed securities is the Fed, but they cut back their purchases in order to slow down home price inflation!

The View From Here

Within the first 12 days of 2023 I helped one seller in Florence get under contract within 12 days of being on the market. At the same time, I helped a buyer win a home over a competing offer in Alberton. Then, a buyer tour in Missoula I planned last week for someone else had 3 of the 4 homes on it go under contract before we were able to see them. My point is not to show off, but to tell you that the housing market may look different from 2022, but is still very much alive and kicking. Curious to know what is happening in your neighborhood? You can sign up for local listings and targeted market data here: https://sashavermel.com/

Now for the numbers:

Missoula County

Ravalli County

Mineral County

Lake County

Flathead County

October 2022 Western Montana Market Report

I’m watching the snow come down as Western Montana made the very fast transition from late summer sun to two perfect weeks of fall then a winter storm. I love the beginning of winter here, and joked with a client recently that the mountains get all dressed up for us this time of year.

Trends

The biggest story in real estate continues to be interest rates. As I write this the average conventional 30 yr loan is around 7.5%, compared to 3.5% one year ago. Money is just much more expensive to borrow, and demand for home mortgages has declined.

Across the region, both mortgages and closed home sales were down this October vs October 2021. In Missoula County, home sales were down 13.6% from one year ago, while the number was -16% in Ravalli County, and -25.6% in Lake county. Seasonally things slow down this time of year, so we should expect the number of closed sales to continue to decline through February.

Based on the data we have now, It is looking like prices peaked in June and July, with deals that went under contract when interest rates were under 5.5%. Median home prices are down since July, but up double digits since one year ago.

While demand is down, there is still not enough supply of affordable homes. In Missoula county, move in ready homes that are priced in the low to mid price points are still being sold in a few days with competing offers. As of the end of October, there were 271 homes for sale. To compare, Ravalli County, with less than half of the population of Missoula, had 248 active listings. This is why Missoula has 2.5 months supply on the market, and Ravalli county has 4 months supply. (Months supply is the length of time it would take to sell the number of homes currently on the market.) Of the homes that are available, more than 40% are priced over $800,000. That is hardly what most Montanan’s would consider affordable.

Looking to sell?

It is a good time to talk to a real estate agent to find out what is happening in your neighborhood. Your home might have 20 people at the open house and be under contract two days later, or it may sit on the market for 81 days or more. It varies widely, and pricing really matters. If you are thinking about selling in the spring I think it is worth planning to put new paint on the walls or do that partial kitchen remodel. Millennials are the largest generation in history and they want to buy. What they don’t want (or can’t afford) is a home that needs a lot of fixes and updating. There is a much larger demand for turnkey properties than for fixer uppers.

Looking to buy?

There is a saying in real estate that you marry your house, and date your interest rate. There will likely be opportunities to refinance at some point in the future, and most lenders can do a refi at no out of pocket costs to borrowers if you have at least 20% equity in the home. Get familiar with the following routes to make monthly payments more affordable right now.

The Numbers!

Missoula County

-Missoula County residential media home prices are down 9.6% from the peak of $575,000 in July. Median prices are still up 10.3% year over year.

-Absorption rate: Missoula county has a 2.5 month supply of all homes. There is less than 1 months inventory for homes priced under $500k.

-Sellers are receiving 99.9% of asking price, on average.

-Median days on market before going under contract is averaging 55, but is 47 days for homes priced under $650K

-Closed sales are down 13.6% year over year, for a total of 127 homes in October 2022

-Homes available for sale are fairly flat over the last 4 months. Inventory is up 64% over this time last year.

-There were 271 homes for sale at the end of October. Of those, 116 (42%) were listed for over $800,000. 28% of all homes were listed for over $1 million. 9 homes worth over $800 closed in October.

Ravalli County

-There are currently 248 homes for sale in Ravalli County, population 45,000, compared to 271 in Missoula County, population 119,000. Of the 248 homes for sale in Ravalli County, 46% (116) of them are priced over $800,000. In the month of October, 13 homes sold for more than $800K.

-The median sales price was $600K, down 11% from July, but up 32% year over year.

-Closed sales are down 16% year over year.

-There were 44% more homes on the market in October than one year ago, and at the rate homes are selling, it would take 4 months to sell the number of homes that are currently on the market (months supply).

Lake County

-Median residential home prices were $635K in October, down 15% from their peak in July, but still up 47.7% year over year.

-New listings were down 28% from this time last year.

-51% of all available home listings in October were listed for over $800,000.

-Closed sales were down 25.6%.

-There is currently 3.9 months supply, with only 2 months supply of homes listed under $499,000

-Sellers in Lake county received a median percent of list price received of 97%. Down 3% from one year ago.

Mineral County

-Median sales price for closed sales was $449,900 in October, up 41% from one year ago.

-Housing inventory is up 20% from a year ago.

-Closed sales are down 30% from October of 2022.

-Mineral county ended October with 5 months supply of homes on the market.

If you would like to know what is happening in your neighborhood, I would be happy to give you a more specific snapshot. Feel free to drop me an email, or give me a call at 406-404-6241. You can even register yourself to receive monthly updates of your neighborhood here https://sashavermel.com/neighborhood-news

July 2022 Northwestern Montana Market Reports

The Big Picture

After two years of steep home value appreciation, and mortgage rates doubling in the last 6 months, the July median sales prices for homes dropped across Western Montana. This is the story I expected to tell in June, but instead we had the highest ever median home prices recorded in Missoula, Ravalli, Mineral and Flathead counties. In Missoula County the median residential home sales price fell from $575,000 in June to $525,000 in July, a 9% drop in one month. In Mineral County, the median home price fell 34%. Is this a blip, or is this the beginning of a downward trend? Will we level out into a new normal? These are the big questions. Sometimes the median price drops from one month to the next, it’s the overall trend that matters and the trend has been up and up and up.

The “price falling” narrative feels right because we are seeing so many price reductions on active listings. It seems intuitive that higher interest rates mean fewer qualified buyers, and two years in a row with 23% annual price growth (most homes doubled their value since 2019) mean that many people have a lot less purchase power than they used to, or have been priced out of the market all together.

One other trend I’m seeing across Western Montana is that the number of new residential listings is down a little from previous years, but the number of closed sales is down a lot. The combination of high prices, higher interest rates, and not enough desirable property to choose from is driving down the number of closed sales. Closed land sales are lagging new land listings even more than residential- this may be a combination of pessimism about home values in the future and a reaction to the high building and materials costs of the moment.

From reading this, you might jump to the conclusion that “offer dates” and multiple offers are a thing of the past. You would be wrong about that. It really varies listing to listing. Homes that are priced a little under market value, and newer or updated homes in desirable areas can still draw 8 offers within days of being listed.

Advice for Buyers

Buyers should be extremely conscious of listing price right now. Make sure to look at a CMA before making any kind of offer. Some homes are priced low to drive interest, some home are priced high just in case the seller can get the top dollar. Initial list prices are all over the place right now as agents try to find the magic number to bring in offers. If you like a home, but the price seems high it may be worth waiting to see if the price goes down later or even make an under asking offer to see how the seller responds.

Advice for Sellers

Are you wondering if you should replace the flooring, update the kitchen or refresh the paint? At this moment there is such a strong demand for move-in ready homes that I think you either need to do the updates, or be prepared to sell your home for less and for it to take longer to get an offer. For people selling luxury homes- there is less demand at the moment and more inventory than there used to be. Luxury sellers can expect their homes to stay on the market longer.

Want to get my Market Update in your email inbox every month, plus get updates and new listings on a particular zip code?

Sign up for Neighborhood News here: https://sashavermel.com/neighborhood-news

Find the charts and numbers for your county below!

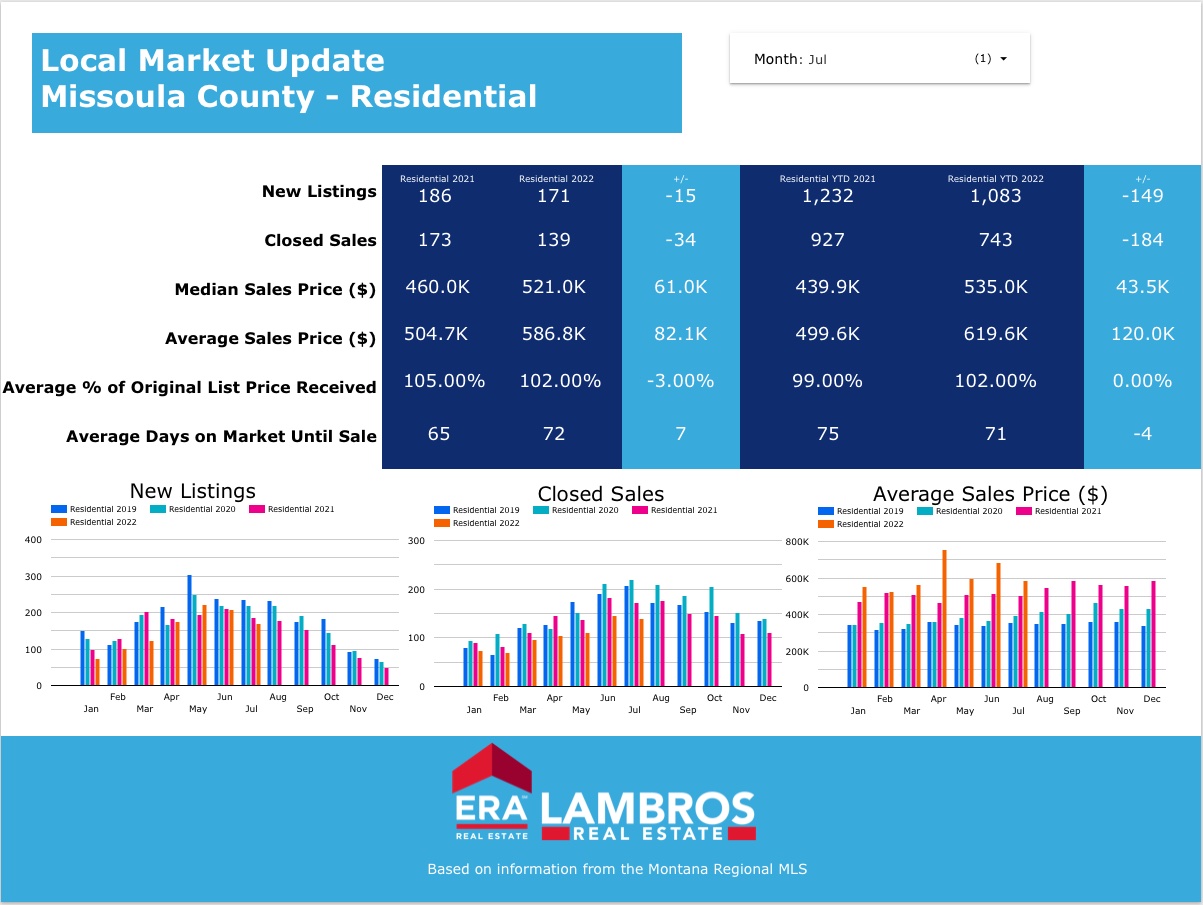

Missoula County Residential

There were more homes on the market this July than at any time since August of 2020. New listings are down two months in a row, and down from this month the last 3 years. The average percent of asking price received on closed sales is down 3% from this time last month.

Median sales price fell 8.6% from last month.

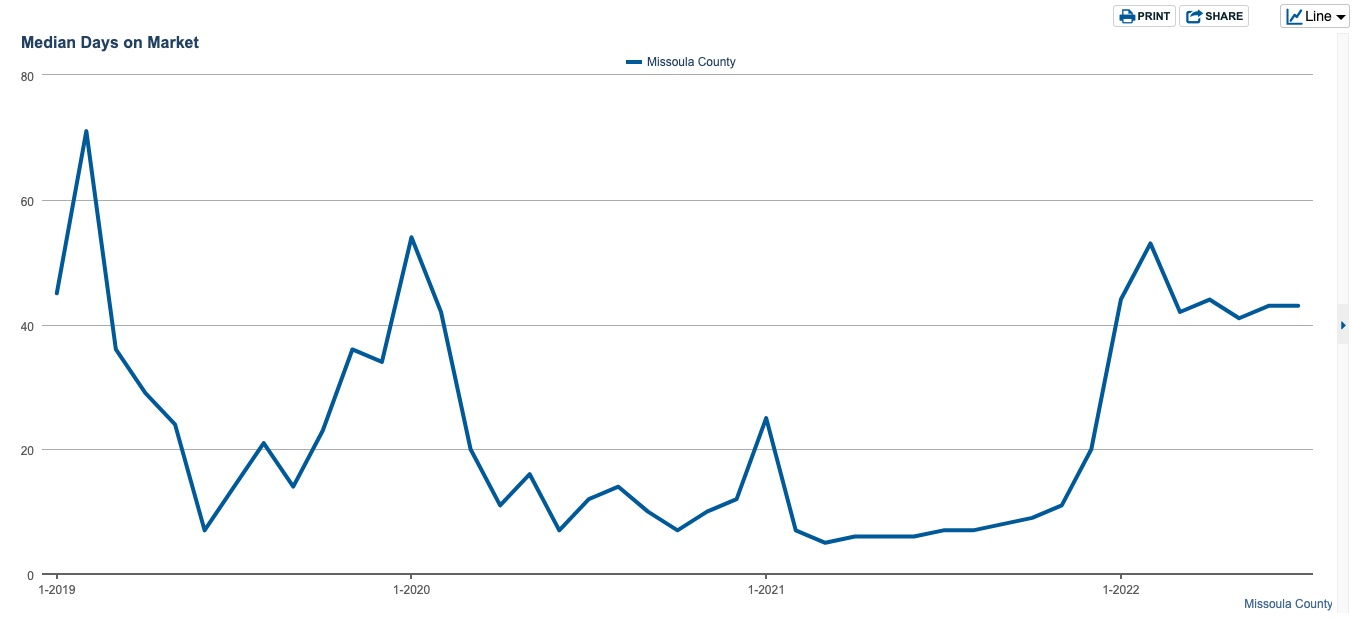

Median days on market before going under contract seems to be settling into a new normal.

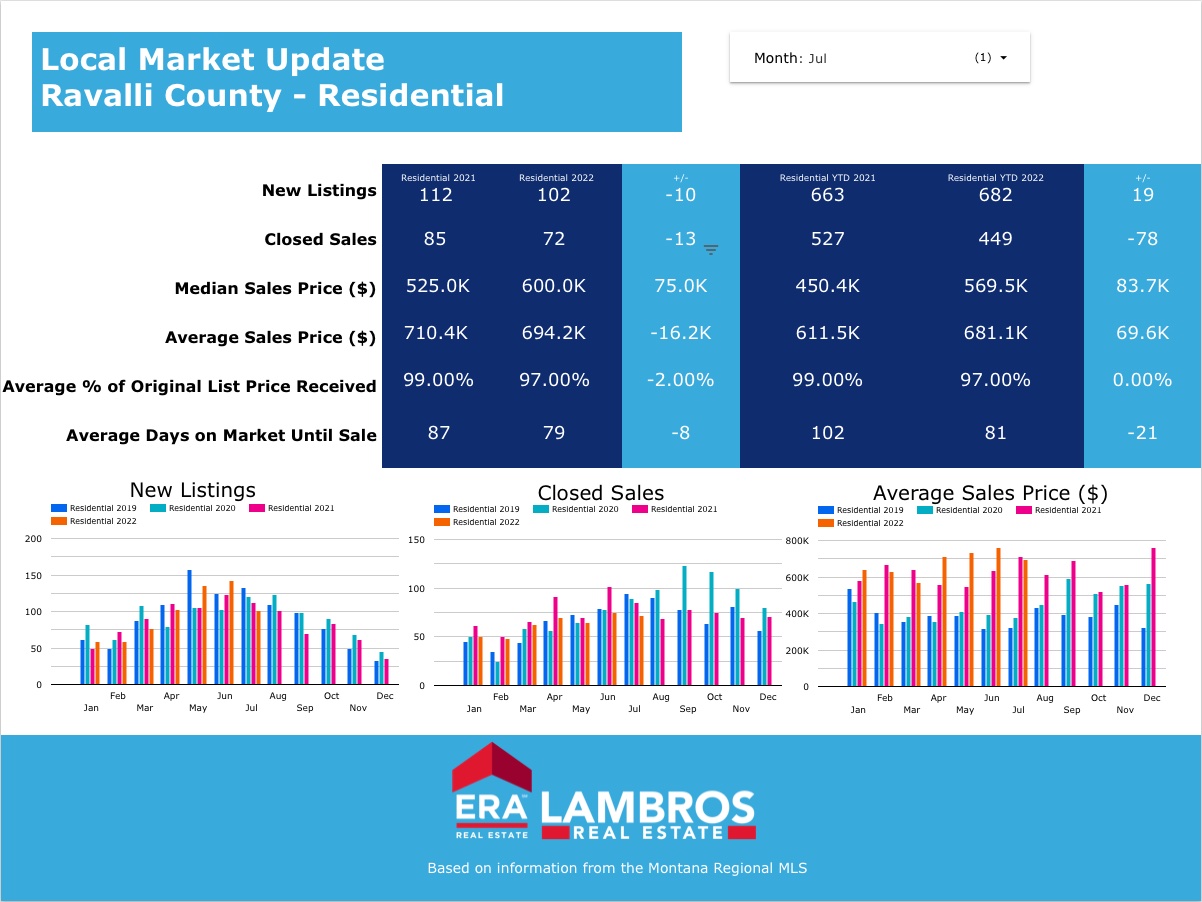

Ravalli County Residential

Year to date new listings are up slightly, but closed sales are down 15%. Median sales prices for Ravalli County was at $600,000 in July. And that’s down from $675,000 in June. Everyone wants the story that prices are coming down, but the trend line continues up. Even $600k is the second highest ever monthly median price in the county. Average % of list price is down to 97% for both the month of July and year to date in the county.

Ravalli County had 3.8 months of supply as of July, the most since June of 2020. That breaks down to 9 months of inventory for homes priced over $800k, and 2.2 months of supply of homes listed for under $600k.

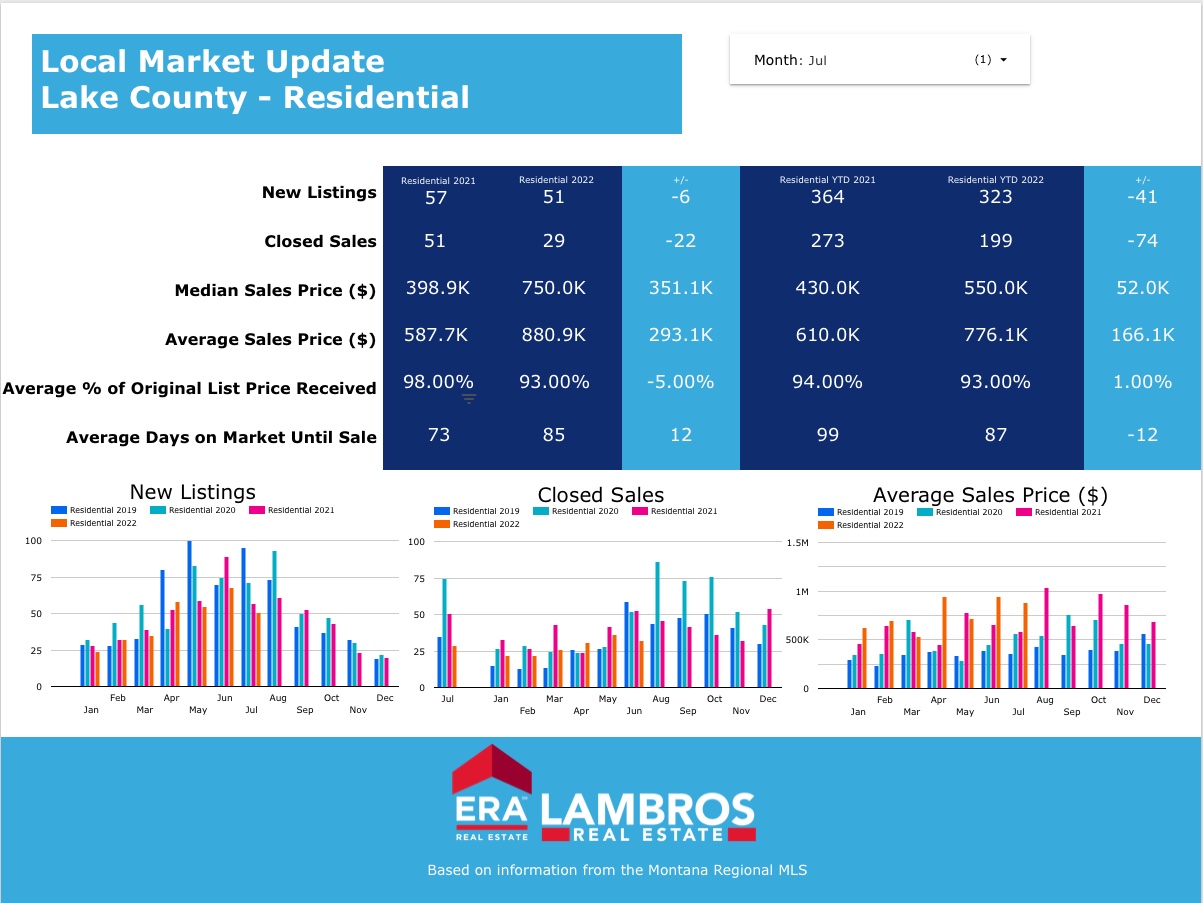

Lake County Residential

New listings are down 11% year to date, but closed sales are down 27% year to date.

Average % of original list price on closed sales is all the way down at 93%.

Breaking the trend of most of the region, Median Sales price hit a new high in Lake County in July, topping out at $750k, with an average sales price of $880.9K. Lake county currently has 4.3 months of housing supply, more than any county in the region except Flathead.

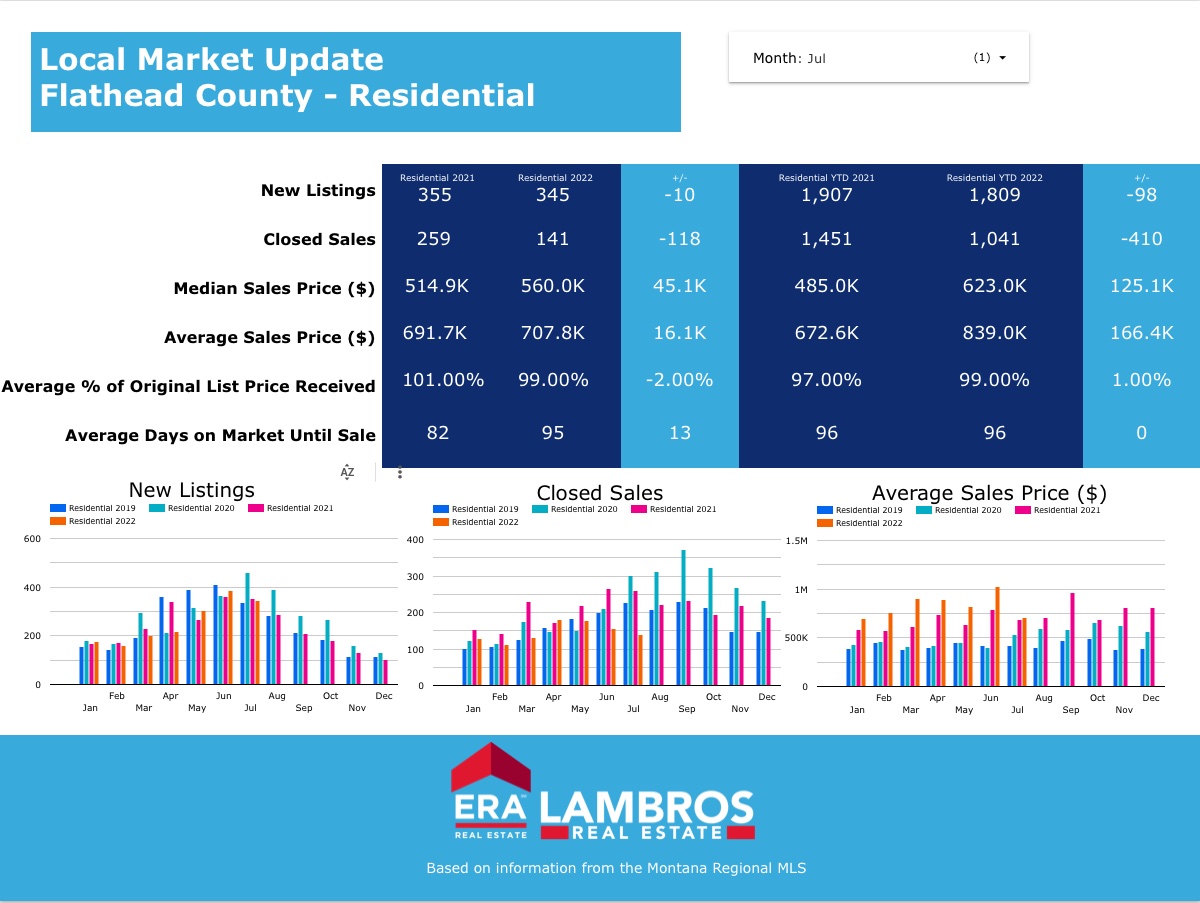

Flathead County Residential

New listings year to date are down a little- 5%, but closed sales are down a lot- 28% year to date. With fewer closings there were 4.7 months supply on the market.

Median sales price went from $697,000 in June, While the July median sales price went down to $560,000.

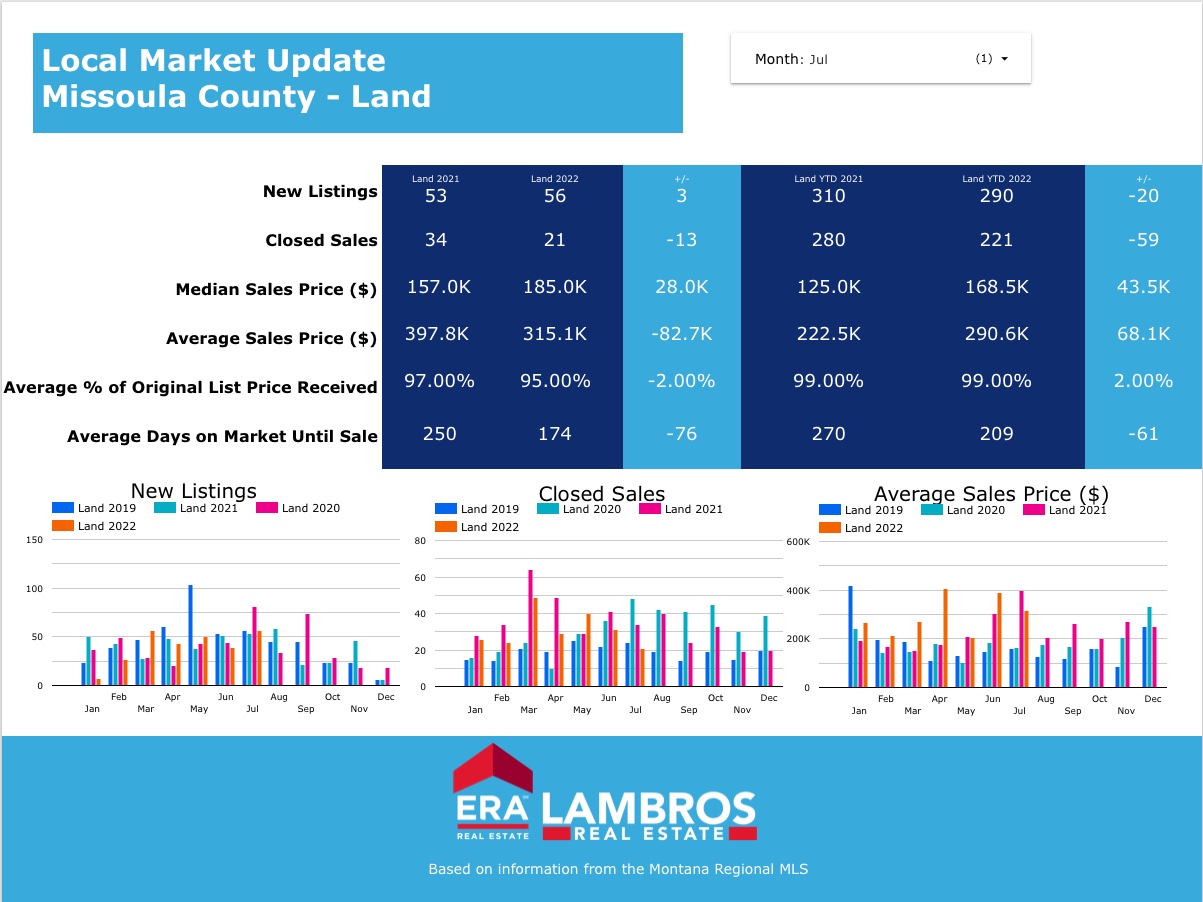

Missoula County Land

For the month of July, average % of list price was only 95% despite being 99% ytd in both 2021 and 2022.

The July Median sales price was $185K, and $168k year to date a 34% increase from this time last year.

Average days on market was 174 days in the month of July.

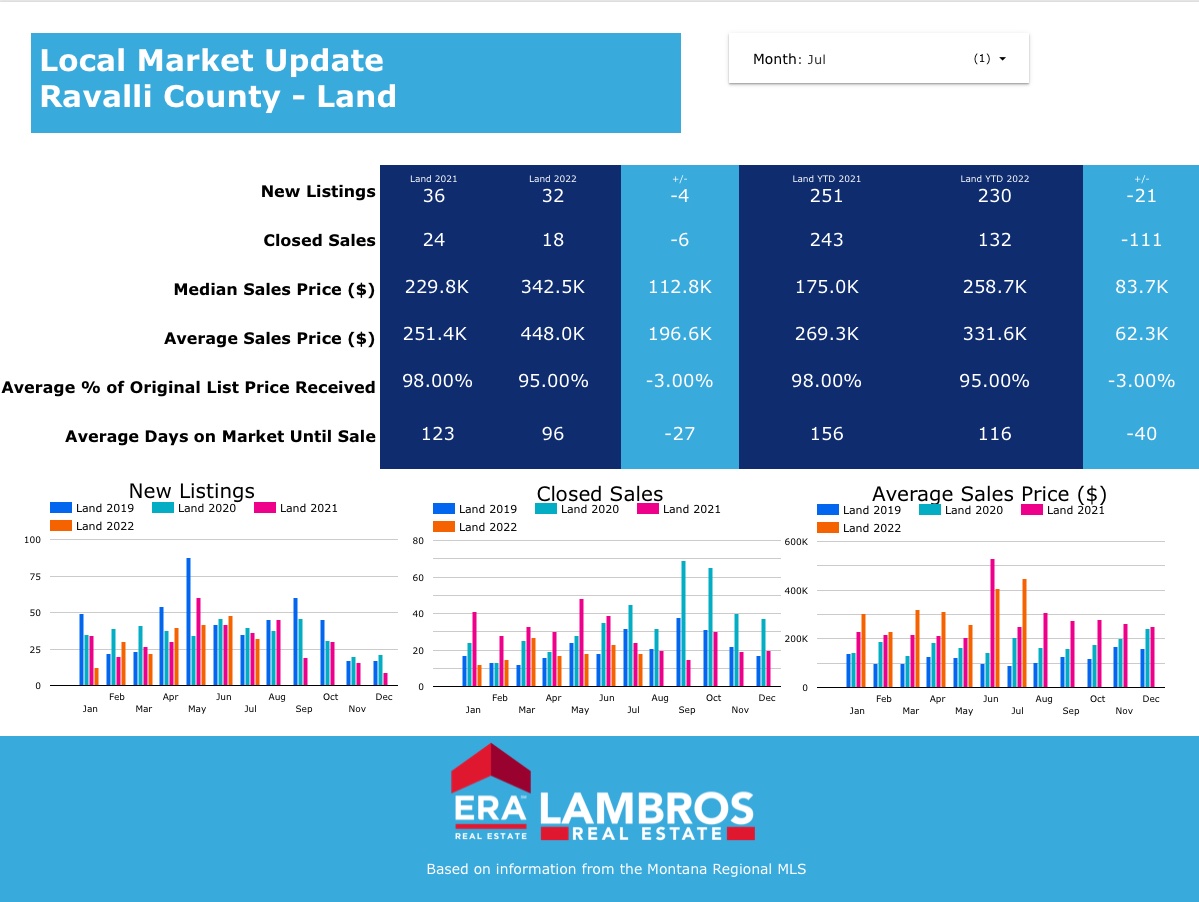

Ravalli County Land

New listings are down a little in Ravalli County, but new closed sales year to date are down 46%. Compare 234 closed sales year to date in 2021, vs 132 closed sales ytd in 2022. Like Missoula County, average % of list price was 95%. The July Median sales price of Ravalli County land sales was $342k, up 49% from a year ago. Average days on market until selling was down to 96 days in July, and 116 days year to date.

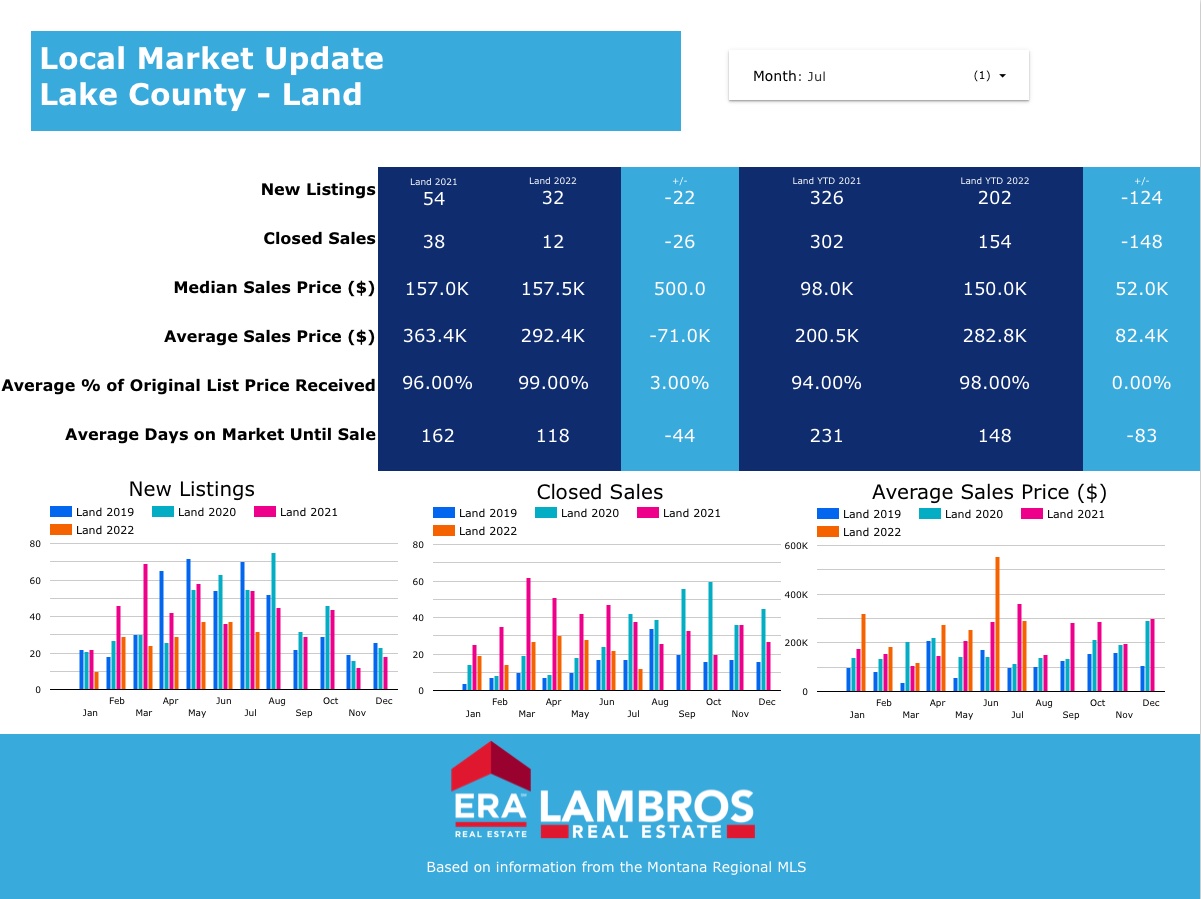

Lake County Land

New listings are down 38% year to date for 2022 compared to 2021 in Lake County. With only 12 sales in the month of July, the median sales price was $157k, and the average was 292.4k. Average % of list price was 99% in July, and 98% ytd.

Missoula County Market Report May 2022

Welcome to your May 2022 Market Report

It’s summer! Interest rates are averaging over 6%! One thing that everyone knows about Montana weather is that if you don’t like what is happening, just give it 5 minutes. Well, if you didn’t like what the real estate market has been doing for the last 2 years here is your chance for something different.

On the ground I feel the shift in the Missoula housing market. Last year, for 8 months in a row the average home got under contract within 7 days of being listed in Missoula county, and in May of 2022 that number has shifted to 19 days. A few months ago there would only be a handful of price reductions per week, and now I’m seeing almost 1 price reduction per 2 new homes listed. The fed is raising interest rates to cool inflation, and housing cost inflation has been rampant in the last few years. 23% annual increases in median home prices is not sustainable. Home prices are adjusting accordingly. This isn’t an accident, it is the point of interest rate increase. Take a look at the median days on market in Missoula County in the chart below.

Good News for Buyers

For people trying to buy real estate, the good news is that sellers don’t get to just have their way with you. Where there used to be 15-20 offers on a median priced home, there may only be 3 or 4 today. Or only 1 offer. Or the price gets reduced because they only had 2 showings the first week. Sure, there are still unicorns that get multiple offers, but be on the look out for opportunity. With less competition, you are more likely to get an offer accepted with an inspection, at asking price, or even for under asking price again. Sellers are also more motivated to offer concessions if something comes up during inspections. The downside for buyers right now is that money is more expensive to borrow, and anyone that got pre approved 2 months ago needs to talk to their lender to find out what they can qualify for today. Buyers also need to be prepared to pull down payment money out of the stock market or money market accounts well before closing so they don’t find themselves coming up short when closing arrives.

Sellers will have to adjust

For people thinking about selling, answering the question, “but where will I go?” got a little easier. With less competition it is easier to get under contract for the next home contingent on the sale of you existing home. We are at the top of the market, and you can still get a great price for you home. It’s just less likely that you will get the $50k over asking or the big bidding war that you have been hearing about. If you are selling, you also don’t have to feel like you are leaving money on the table by waiting 6 months. The downside for sellers is that they may have to do the updates to the flooring or walls to make the house move-in ready. Homes may not go under contract within 5 days of listing. Sellers are going to have to be more patient, and more flexible, especially when negotiating contracts and inspections.

It’s not time to freak out or panic. For most of the last 100 years, interest rates have been over 5%. People still need somewhere to live, Western Montana is still a great place, and remote work is going to continue to be available for a certain percentage of the workforce. If you are trying to buy or sell it is important to stay current with the latest numbers and trends and to be ready to adapt as the market conditions change.

Now for the May numbers!

New listings were up in the Missoula housing market in May by 14% over last year. We saw 222 new listings, and 111 closed sales, so 2x as many listings as closings. Closed sales were down this year compared to last year, but I attribute that to the lack of new listings in February and March of 2022. When average days on market is 65, that means we can only close on what got listed two months ago. The median sales price for residential property in missoula county is up by 25% the first five months of 2022, compared to 2021.

If you want to learn more about what is happening in your neighborhood, please reach out to me at sashavermel@eralambros.com

For numbers focusing on Ravalli County look here: https://sashavermel.com/2022/06/24/may-2022-market-report-ravalli-county

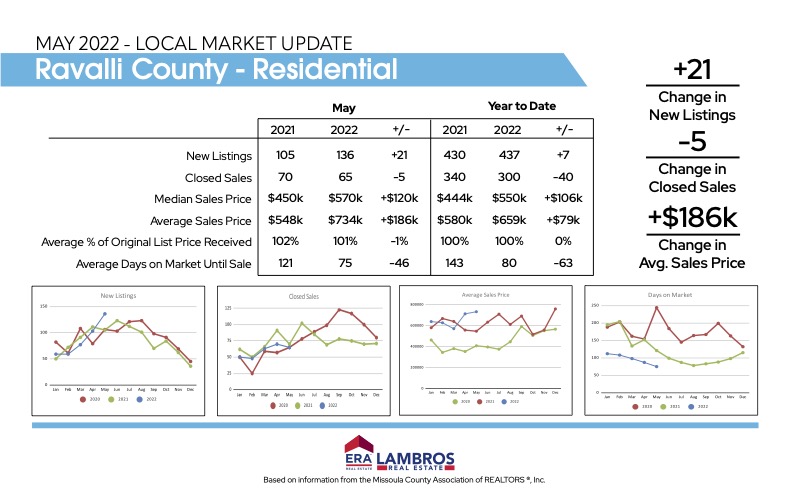

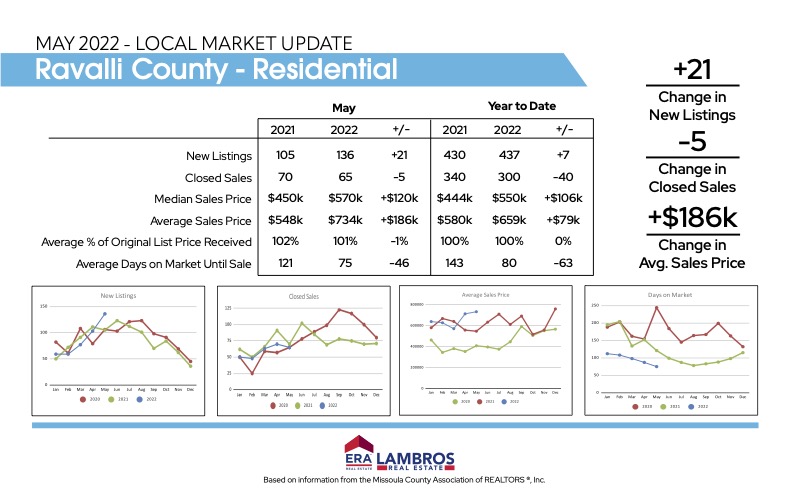

May 2022 Market Report [Ravalli County]

It’s summer! Interest rates are averaging over 6%! One thing that everyone knows about Montana weather is that if you don’t like what is happening, just give it 5 minutes. Well, if you didn’t like what the real estate market has been doing for the last 2 years here is your chance for something different.

On the ground I can tell you that I feel the shift. Last year in Ravalli County for 5 months homes averaged less than 20 days on the market before going under contract, and in May of 2022 that number has shifted to 31 days. A few months ago there would only be a handful of price reductions per week, and now I’m seeing almost 1 price reduction per 2 new homes listed. The fed is raising interest rates to cool inflation, and housing cost inflation has been rampant in the last few years. 23% annual increases in median home prices is not sustainable. Home prices are adjusting accordingly.

For people trying to buy real estate, the good news is that sellers don’t get to just have their way with you. Where there used to be 15-20 offers, there may only be 3 or 4. Or only 1 offer. Or the price gets reduced because they only had 2 showings the first week. Sure, there are still unicorns that are priced to generate lots of interest, but be on the look out for opportunity. With less competition, you are more likely to get an offer accepted with an inspection, at asking price, or even for under asking price again. Sellers are also more motivated to offer concessions if something comes up during inspections. The downside for buyers right now is that money is more expensive to borrow, and anyone that got pre approved 2 months ago needs to talk to their lender to find out what they can qualify for today. Buyers also need to be prepared to pull down payment money out of the stock market or money market accounts well before closing so they don’t find themselves coming up short when closing arrives.

For people thinking about selling, answering the question, “but where will I go?” got a little easier. With less competition it is easier to get under contract for the next home contingent on the sale of you existing home. We are at the top of the market, and you can still get a great price for you home. It’s just less likely that you will get the $50k over asking or a big bidding war. If you are selling you also don’t have to feel like you are leaving money on the table if you could wait to sell in 6 months. The downside for sellers is that they may have to do the updates to the flooring or walls to make the house move-in ready. Homes may not go under contract within 5 days of listing. Sellers are going to have to be more patient, and more flexible.

It’s not time to freak out or panic. For most of the last 100 years, interest rates have been over 5%. People still need somewhere to live, Western Montana is still a great place, and remote work is going to continue to be available for a certain percentage of the workforce. If you are trying to buy or sell it is important to stay current with the latest numbers and trends and to be ready to adapt as the market conditions change.

Now for the May numbers!

New listings were at their highest monthly total for the last 2.5 years last month. There were 136 new listings to 65 closed sales, so twice as many listings as closings. It is listings season here, but that is still a substantial jump over anything we have seen in a while. Median home prices year to day are still up 24%. I would expect to see the growth in sales prices we have seen in the past two years start to taper off.

If you’d like more information about your neighborhood, feel free to reach out to me at sashavermel@eralambros.com and I’ll be happy to answer any questions you might have!

8 Steps to buying a home: First step is Financial Planning

It’s winter in Montana, and the bears aren’t the only ones hibernating.

As is typical, new listings are few and far between right now. However, if your new year’s resolution involves buying a new home, this is a great time of year to get your financial house in order.

- Save up for a down payment. While VA loans can require no down payment, most loans will require at least 3-5%. The gold standard is a 20% down payment, which means you can avoid paying for mortgage insurance and expect a better mortgage rate. Loans for commercial property and mobile homes comes can require 25-30% down.

- Build your credit score. Increasing your credit score, paying down credit cards, and making all payments on time will help you qualify for a loan, and get you a lower interest rate

- If you know you want to apply for a home loan in the near future, it is a good idea to wait to apply for a new credit card or car loan until after you have closed on the house. Accounts that have been open for a long time count in your favor, while new accounts and credit checks count against you.

Happy house hunting!

#realtorlife #financialplanning #buildyourcredit #montanarealestate #realestategoals #missoularealestate #newhomebuyer #realestate #buyyourdreamhome

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link